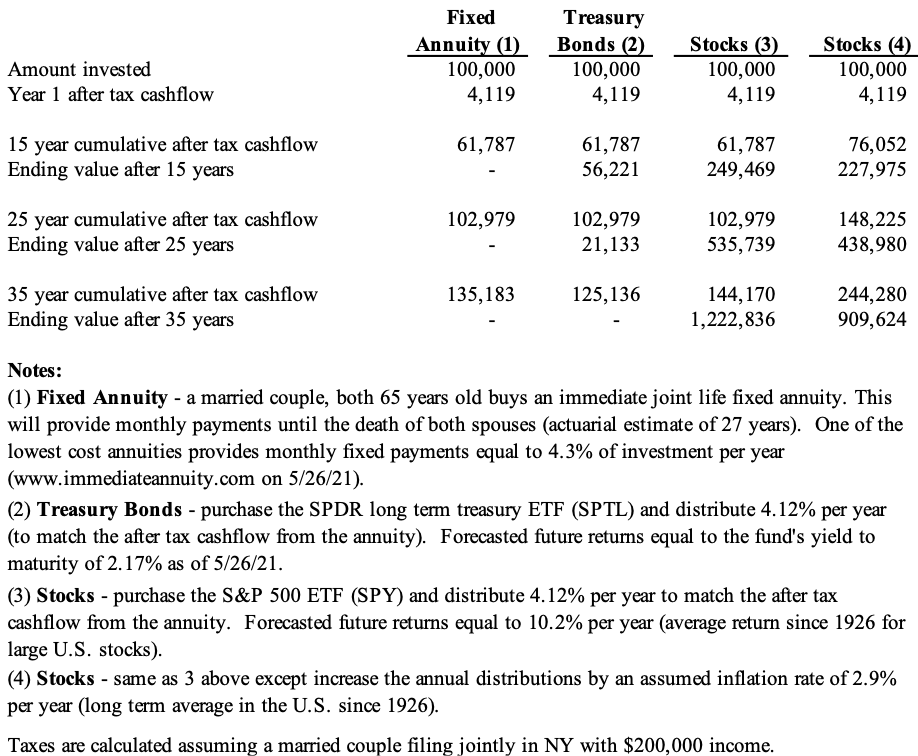

Many financial advisors recommend investing in annuities as they often include very generous commissions for the salesperson. Returns to investors are often not as good. However, certain annuities may have a place in a diversified portfolio as a replacement for fixed income. Below is an analysis of the after-tax cash flows from an investment in a commission free annuity compared to a fixed income portfolio and a diversified portfolio of stocks.

Conclusions:

- If you are in good health and expect to live longer than average, annuities can be a good replacement for a portion of your fixed income. In the analysis below, if a couple lives 8 years longer than actuarial estimates, the annuity provides approximately 8% greater after tax cash flow than an investment in a long-term treasury ETF. However, if a couple lives less than actuarial estimates, the long-term treasury ETF provides greater value in the form of remaining assets to bequeath to heirs.

- Annuities are a very poor replacement for the equity component of your portfolio.The analysis below shows an investment in the S&P 500 ETF can provide the same or greater after-tax cash flow during your lifetime and leave more than 9 times your initial investment to your heirs (versus zero from the annuity).

Disclaimer: All information provided is for educational purposes only and does not constitute investment, legal or tax advice, or an offer to buy or sell any security. Source for all return data is “2020 Stocks, Bonds, Bills and Inflation Yearbook”, Roger G Ibbotson and Duff & Phelps. For our full disclosures, click here.